Accounting and tax. It’s important stuff, because you needlessly waste money if you don’t get it right. But it can get complex. That’s why one of our mantras here is to keep it as simple and crystal clear for you as possible.

It’s also why we created Can I claim that?, a regular series where we debunk some of the myths about claiming deductions for you and your business. We’ll look closely at some regular (and not-so-regular) personal and business expenses, determine how much you can claim (if anything), and help you keep as much of your hard-earned money as possible.

Of course, if you have any particular personal or business expenses you’d like us to look at, or suggestions for future topics, we’d love to hear about them. Tell us about it on Twitter or Facebook, or simply let us know in the comments section below.

Our first topic is rental properties—how they work from a tax perspective, and what expenses you can (and can’t claim) as an owner.

The basic concepts

In a nutshell, any money you earn from a rental property forms part of your income, and any expenses you incur while earning that money can be claimed as deductions.

Simple, right? Unfortunately, in reality it’s not quite so straightforward. So let’s look at it in a bit more detail.

What expenses can I claim?

When it comes to rental properties, there are two types of expenses:

- Ongoing expenses

- Capital expenses

You can potentially claim both types of expenses for a rental property. However, each has its own set of rules for what you can claim and how you go about claiming it. So let’s look at each one separately, starting with…

Ongoing expenses

When you own a rental property, you often have to pay for things such as:

- Accounting and financial advice

- Cost of completing a depreciation schedule

- Landlord insurance

- Building and contents insurance

- Accounting software to track your expenses

- Bank fees

- Property agent management fees

- Strata fees

- Council rates

- Water rates

- Advertising for a tenant

- Travel costs associated with property inspections

- Cleaning of the property

- Gardening/lawn mowing services

- Window cleaning

- Repairs and maintenance

- Pest control

The good news is that whether you’re converting your primary residence (where you currently live) into a rental property or buying an investment property specifically to rent out, you can usually claim these expenses (known as ‘ongoing expenses’).

However, you can only claim them once your property is available for rent.

So if you pay someone to mow the lawns as part of getting your property ready for renting (and those all-important photos), you can’t claim that expense. It’s considered ‘private in nature’ because you’re basically cleaning up your own mess.

But if you get the lawns mowed after your property becomes available for rent, then you can claim the cost—regardless of whether you actually have a tenant.

Ongoing expenses must also:

- be common and generally accepted expenses, such as the examples given earlier. Ongoing expenses are usually:

- repairs (something has broken and needs fixing)

- maintenance (the lawn needs mowing or the trees need pruning)

- costs associated with managing the property (such as agent fees and insurance).

- have short-term rather than long-term value. Fixing an air conditioner has short-term value, but installing an air conditioner has long-term value and is considered a capital expense (which we’ll talk abut soon).

- be reasonable in price. Paying (or claiming to have paid) an overinflated price for an expense that’s outside the norm will increase your chances of being audited.

- replace ‘like for like’. Replacing a broken bathroom tile with the same or a similar tile is considered a ‘repair’, and so it’s an ongoing expense. But getting rid of all the tiles and laying floorboards would be considered an improvement or upgrade, which makes it a capital expense.

So what exactly are capital expenses?

Anything that increases the value of your rental property and/or extends its life is usually considered a capital expense.

A good rule of thumb is that if you’re:

- adding or installing a new item

- upgrading an appliance or fixture

it will probably be considered a capital expense.

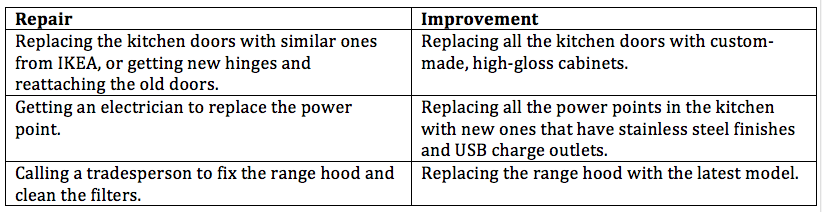

Let’s say there are a few issues with the kitchen in your rental property. A few cupboard doors are broken and have fallen off, a dodgy kettle has damaged one of the power points, and the range hood isn’t working. Here are a couple of ways to solve each problem, and how they would be classified.

Unlike an ongoing expense, you can’t claim a capital expense as an outright deduction (unless it costs less than $300). But you can claim those improvements under depreciation.

How depreciation works

Any improvement you make to your rental property that costs more than $300 (new fixtures or fittings, new appliances, etc.) can’t be claimed as an expense in a single year. Instead, you need to spread it out over multiple years (the ATO will tell you how long). This process is called ‘depreciation of assets based on effective life.’

Generally there are two types of depreciation:

- Appliances and equipment you buy for your rental property (carpets, air conditioners, new range hoods, etc.) These assets are often referred to as ‘plant and equipment’ or ‘fixtures and fittings’.

- Improvements to the building itself—concrete, brickwork, etc. These are often referred to as ‘capital allowances’ or ‘building allowances’, and usually depreciated over 40 years at 2.5% of the original value.

That means you can’t claim the cost of that latest model range hood in one hit. Instead, it needs to be depreciated over the course of its life. Your accountant will work out the percentage you can claim each year using what’s known as a depreciation schedule.

What’s a depreciation schedule?

When you invest in a rental property (or convert your own home into one), you can claim on all of its current assets—even if the property is brand new.

But to do that you need to know what those assets (fixtures, fittings, appliances, etc.) are worth. And that’s where the quantity surveyor comes in. They’ll inspect your property, take notes (not to mention photographs) of everything that can be depreciated, and come up with a depreciation schedule (also known as a depreciation report).

Note: This can’t be done by your accountant, real estate agent or property manager. It can only be done by a qualified quantity surveyor.

According to MCG Quantity Surveyors (who we can certainly recommend if you’ve never used a quantity surveyor before), the best time to get a depreciation schedule prepared is immediately after settlement and just before the tenant moves in. They also suggest you get a depreciation schedule done both before and after you complete any renovations.

Once you have your report, you need to keep it on file in case you’re ever audited.

The good news is you can claim the full cost of using a quantity surveyor straight away. (It’s an ongoing expense, remember?)

An example of what you can claim when you buy an investment property.

Let’s say you just bought a two-bedroom unit in Randwick for $850,000. Of course, you would have also had to pay for legal fees, building and pest inspection, stamp duty on the unit, and borrowing costs.

Now, the legal fees, building and pest inspection and stamp duty on the unit form part of the cost base. (We’ll explain what this ‘cost base is in a moment.) So you can’t actually claim any of them while you still own the property. They’ll be taken into account if/when you sell the unit.

However, you can claim the borrowing costs (stamp duty on the mortgage, mortgage insurance, registration of the mortgage, etc.) as an ongoing expense over the first five years. Just make sure you give the initial mortgage contract to your accountant so they can include these borrowing costs when preparing your return.

I’ve just done some renovations to my new rental property. Can I claim those too?

Unfortunately, there are no hard and fast rules on what you can and can’t claim. It really depends on what you’ve done.

For example, let’s say you buy an investment property that’s a bit run down. Before anyone would even think of living there it needs a new kitchen, new carpets, and a lick of paint. Oh, and the air conditioner needs fixing.

So you install a new kitchen, update the carpets, fix the air conditioner, and hire a painter to give the walls a fresh look.

Now, what can you claim?

Hold your horses. Before you can even think about claiming anything you need to arrange for a quantity surveyor to prepare a depreciation schedule for the:

- new kitchen

- new carpet

- repaired air conditioner

- walls being painted (which will be a building capital work write-off).

Okay, so once that’s done you can start claiming, right?

Well, no.

Yes, the kitchen, carpet, and painting are all capital expenses that can be depreciated over time. And getting the air conditioner repaired would certainly be considered an ongoing expense.

But all of this work was done before the property was available for rent. That means it forms part of the initial property price, and will be depreciated once the property goes on the rental market.

Okay, it’s now a few years down the track, and your tenants (yes, you did get some) have moved out. Unfortunately, they weren’t great tenants. They’ve wrecked the carpets, broken the air conditioning beyond repair, and their smoking habit has ruined the paintwork on the walls. So you need to replace the carpets, give the property a fresh coat of paint, and install a brand new air conditioner.

The good news is your property is now available for rent, which means you can claim the cost of the repairs. Replacing the carpet ‘like for like’ makes it a repair rather than an improvement, and so you can claim it immediately as an ongoing expense. And because the paintwork was damaged by the tenants’ smoking, it’s also classified as a repair you can claim immediately.

Of course, the new air conditioner is considered an improvement, and so will need to be depreciated like any other capital expense.

I’ve had enough of this renting gig, and I’m selling my rental property. Any expenses I can claim as part of the sale?

Not really. In fact, you’ll have to pay money (in the form of Capital Gains Tax) on the profit you make from selling the property. And by ‘profit’ we mean the amount you sold the property for, minus something called the ‘cost base’

And how do I work out this ‘cost base’?

Well, ideally your accountant would do it for you. But to get a rough idea, grab a calculator and punch in these figures:

- the price you initially bought the property for

- + the expenses incurred when purchasing the property (legal fees, pest inspection, etc.)

- + the expenses incurred when selling the property (legal fees, advertising costs, agent commission, etc.)

- + any renovation costs for the property (less the amount you depreciated them by)

- – the depreciation you’ve claimed on the building.

(Now you know why we suggest getting your accountant to do it.)

As you can see, you can’t really claim any expenses when selling a property. They all form part of this ‘cost base’, and work towards your capital gains tax calculation.

We understand how confusing this might be, so don’t hesitate to get in touch if you’d like us to clarify anything for you.

Are there any online accounting tools that can help me manage my property’s income and expenses? (I hate spreadsheets.)

Here are a couple of options you could try:

- We can look at setting up Xero Cashbook for you (the basic form of Xero). It downloads your bank account data, which we can then reconcile against a chart of accounts to help you identify your income and expenses.

- If you’ve got a few rental properties you may also want to check out Re-Leased or Real Estate Investar (which both integrate with Xero) to help eliminate that dreaded data entry.

And of course, the costs of setting up and running these packages are tax deductible. (Recognised them as an ongoing expense? Go to the top of the class. Here’s your gold star.)

5 Take Away Tips:

As you can see, you can claim for a range of items, although maybe not straight away.

Here’s a quick summary of what you need to know.

- Get a depreciation and/or scrapping schedule when you first buy a property, and chat to a quantity surveyor before you do any renovations. Their depreciation schedule will help you claim deductions against your rental income and bring your profit margin down, which means you’ll pay less tax.

- Not all items are claimable – especially if your property isn’t currently available for rent.

- Try to make your repairs ‘like for like’ so you can immediate claim them as ongoing expenses rather than having to depreciate them.

- Look into online accounting systems that help you manage your income and expenses so you always know how your property is performing.

- Talk to your accountant before you buy or sell an investment property (or rent out your primary residence) in case there are any capital gains tax implications you weren’t aware of.

That’s it for this edition of Can I claim that? If you have any questions about what we’ve talked about, don’t hesitate to get in touch with us. And if you have any suggestions for future topics, let us know in the comments section or via Twitter or Facebook.

The information in this article is of a general nature only, and doesn’t take your specific needs or circumstances into consideration. You should look at your own personal situation and requirements before making any financial decisions, and contact an accountant or financial advisor.